Budgeting

So what is a budget? A budget is a tool to help you be more wise with your money. You decide where your money should be going prior to spending it, to help you be more intentional. In general, this helps you to avoid the impulsivity of daily spending. This, in turn, helps you to repay debt, avoid falling into debt, or meet your savings goals. You can’t change your habits if you don’t have any data. So what are some spending categories that we need to pay attention to?

Necessary Spending

Rent

Groceries

Utilities

Minimum debt payments

Car payments

These are your non-negotiable expenses. You need somewhere to live, you need to eat food, you need to get to and from work. If you don’t pay these, you won’t survive. If you can’t fit these expenses into 50% of your budget, you either need to downsize your lifestyle, or increase your income.

Necessary Spending

Discretionary Spending

Concert/Sporting Event Tickets

Vacations

Unnecessary clothing/accessories

Streaming subscriptions

These are purchases that make your life better. They’re the things you want, but don’t need. These are the purchases that bring enjoyment to life. Maybe you buy a nicer car than you need. Maybe you choose a fancy restaurant instead of cooking at home. You can and should do these things if they fit into your budget. The problem arises when people prioritize this category of spending of necessary expenses or savings.

Discretionary Spending

Savings and Debt Repayment

Emergency Fund

Debt Repayment beyond minimum monthly payments

Investing (IRA, HSA, 401(k), Taxable Brokerage Account)

Other Savings goals (down payment, starting a business…)

This category of spending is to prepare for your future. I’ve purposefully listed these in the order that I did. You should always have an emergency fund, and this fund should grow with your financial maturity. When you’re starting out, maybe this is only $1,000. It should eventually grow to 3-6 months of expenses. Debt repayment is so important. Credit cards are an amazing tool, but they ruin so many people’s financial lives. Prioritizing paying down high-interest debt is a must. Next comes investing for the future. Compound interest is an incredibly useful tool, and it is most useful if you start early. Finally, other savings goals should be approached.

Now, let’s look at some different types of budgets.

Savings

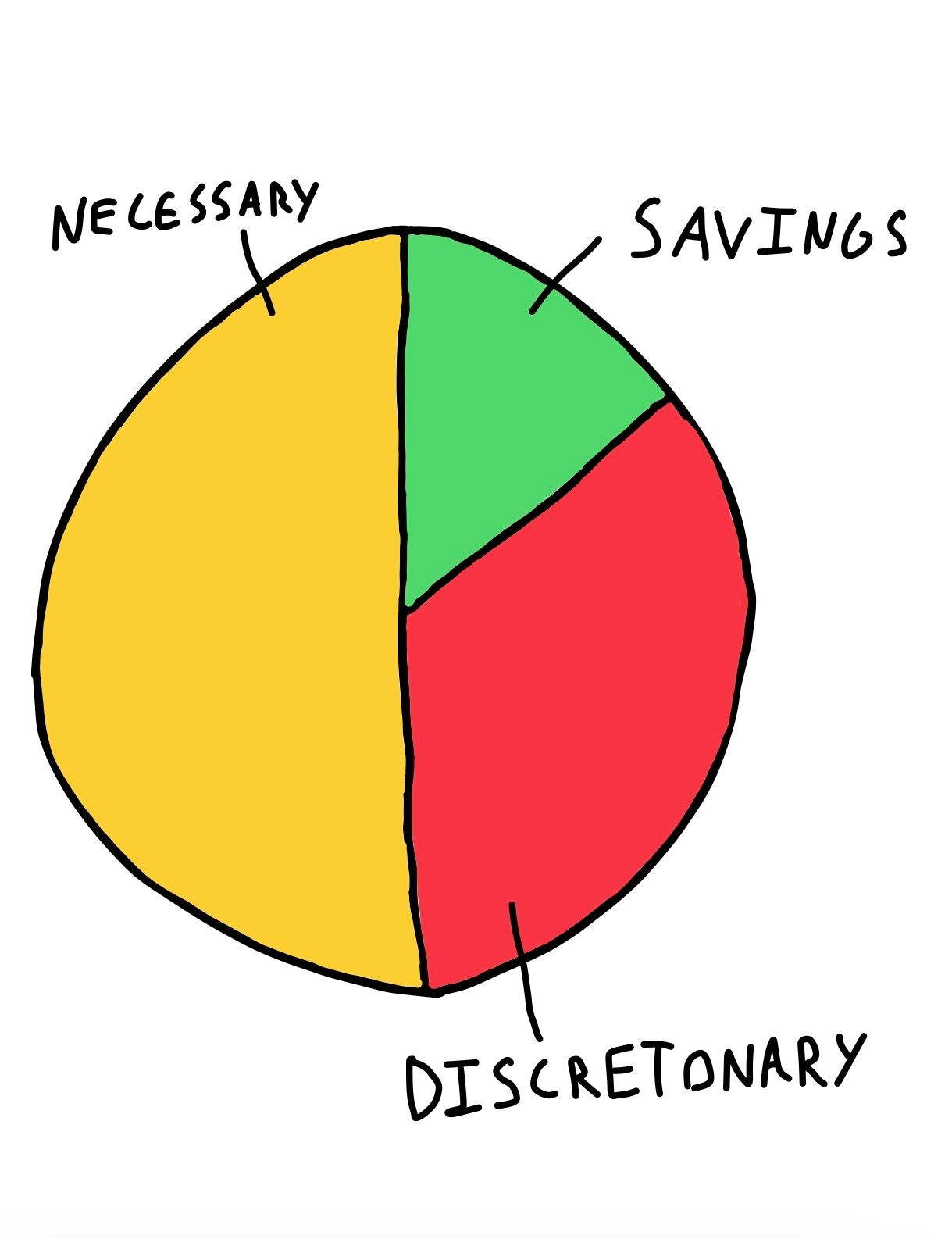

50/30/20

The 50/30/20 budget says that 50% of expenses should be necessary spending, 30% should be discretionary spending, and 20% should be savings and debt repayment. The 50/30/20 budget is a great starting point for a budget, however, it isn’t a strict rule.

Maybe you have significant high-interest debt. In that case, it would be wise to make temporary sacrifices and reduce your discretionary spending in favor of paying down the debt, so your budget is more of a 50/10/40.

Maybe you live will below your means and you save aggressively to retire early. Then your budget might look like 30/30/40.

Everyone has a different situation, but you can tailor this strategy to yours.

50/30/20 Breakdown

Zero Sum

A zero sum budget conceptually very simple.

Income - Expenses = $0

You look at how much money you bring in, you mark down all necessary bills (rent, utilities, food), then the remainder is left to plan out savings/discretionary spending. Counting savings as an expense (as it should be going to a different account), the net change in your account each month should be $0.

This type of budget takes a lot of diligent work. Generally, I think it’s easier to start with a less strict budget and adjust as you learn your expense patterns, but if you’re already in debt, or you have a low income compared to your necessary expenses, you may not have the luxury of starting with an easier budget.

Balanced Income and Expenses

Pay Yourself First

This strategy involves taking a careful look at your necessary expenses. Then, you set an automatic transfer for your savings/investments at the beginning of the month. Any remaining money is yours to spend. This is a strategy that requires some up front work, and then becomes automatic. This strategy tends to work well with those who are either very organized with their expenses, or they make far more money than they need for their necessary expenses.

Pay Yourself First!

Conclusion

There are many different types of budgets that you can try, but the most important thing is that you’re paying attention to where your money is going. Regardless of how you choose to budget, it takes discipline and delayed gratification to meet your financial goals.

I’ve modified the Google Sheets Budget Template to include a breakdown of Necessary Spending, Discretionary Spending, and Savings/Debt Repayment. Check it out if you need an example for what a budget might look like!